11 Essential Features Every Crypto Trader Needs in a Trading Tool

In the fast-paced world of crypto trading, the right trading tool can make all the difference. Whether you’re a seasoned trader or just a beginner, having a reliable platform with advanced automation features is crucial. Let’s dive into the must-have features that every crypto trader needs to navigate the volatile market effectively.

1. Real-Time Market Data Access

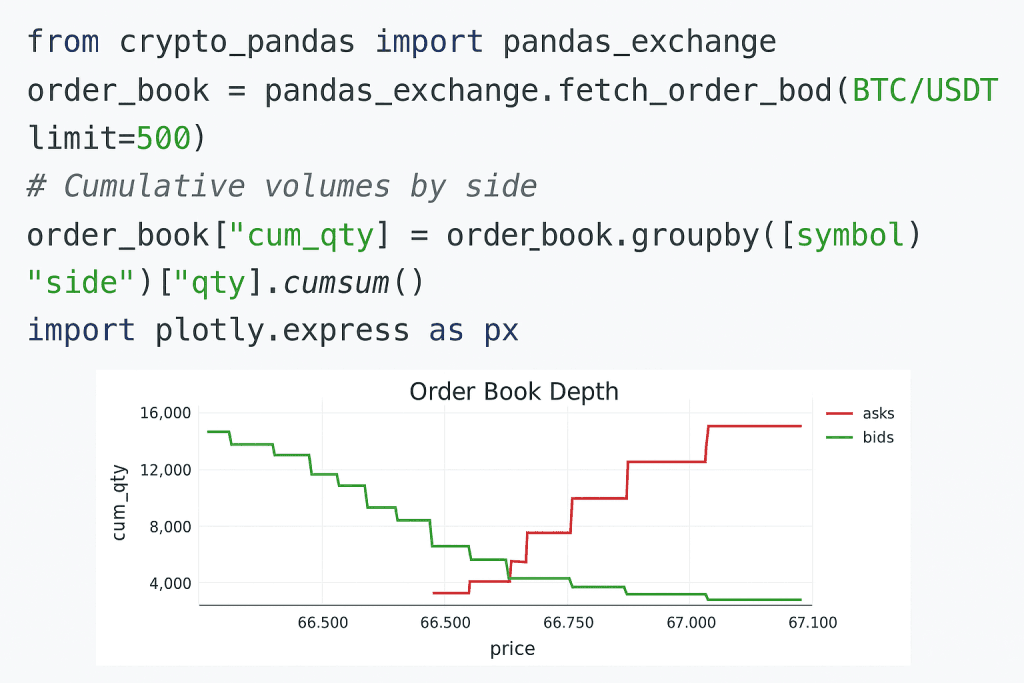

Real-time data is the backbone of successful crypto trading. Your trading tool should provide access to live price feeds, order books, and market trends. This ensures that you can make informed decisions at the right moment.

With accurate market data, traders can track price fluctuations, assess liquidity, and identify opportunities. Tools like Crypto Pandas leverage APIs to deliver seamless data updates, ensuring you stay ahead of the curve.

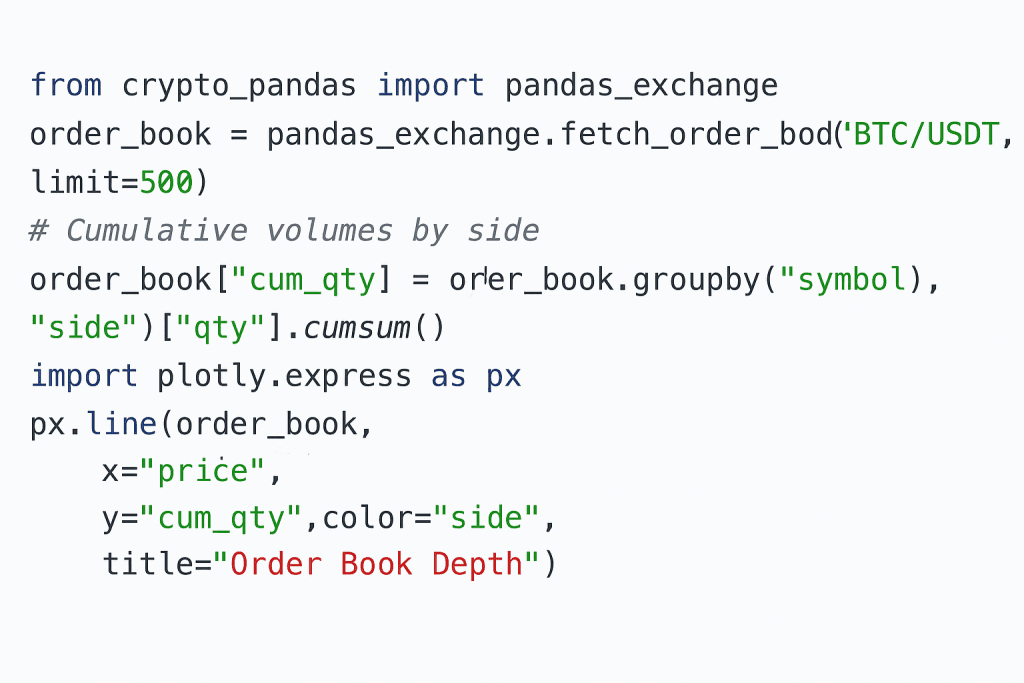

2. Advanced Automation for Trade Execution

Automation is no longer optional; it’s a necessity. Advanced automation features like algorithmic trading allow users to execute predefined strategies without manual intervention.This reduces emotional decision-making and improves consistency. Platforms such as Crypto Pandas use Python libraries to automate repetitive tasks, giving traders more time to focus on strategy rather than execution.

3. Intuitive User Interface

A clean, user-friendly interface is vital for effective crypto trading. Navigating through complex charts and data streams should be straightforward. The best trading tools prioritize user experience. By integrating customizable dashboards and clear navigation, these tools enable traders to quickly access the information they need, even under time-sensitive conditions.

4. Comprehensive Charting Tools

Technical analysis is essential for predicting market movements. A trading tool must offer comprehensive charting features, including indicators, trend lines, and overlays. For instance, advanced charting capabilities help traders visualize patterns and validate strategies. Combining these tools with historical data enhances predictive accuracy, a critical edge in crypto trading.

5. Multi-Exchange Integration

Seamless integration with multiple exchanges is a game-changer. Traders can access various markets from a single interface, reducing the hassle of juggling multiple accounts. Trading tools that offer multi-exchange support allow users to compare prices, execute arbitrage, and manage portfolios efficiently. This feature is especially beneficial for traders targeting diverse asset classes and strategies.

6. Risk Management Features

In the volatile crypto market, managing risk is paramount. A robust trading tool should include features like stop-loss orders, take-profit levels, and portfolio diversification recommendations. These features protect traders from significant losses and ensure that profits are locked in. By automating risk management strategies, tools like Crypto Pandas empower traders to focus on long-term growth.

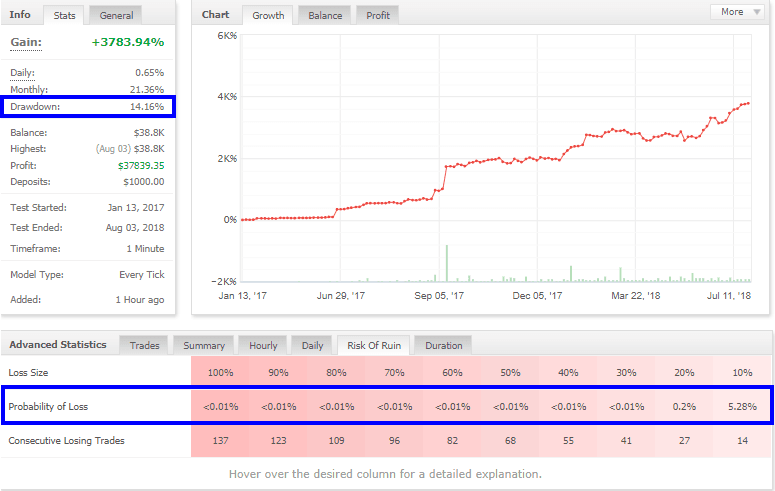

7. Backtesting Capabilities

Backtesting allows traders to test their strategies against historical data. This feature is invaluable for refining approaches before deploying them in live markets. With tools like Python’s Pandas library, traders can simulate scenarios and evaluate performance metrics. Backtesting not only boosts confidence but also minimizes the trial-and-error phase.

8. High-Level Security Protocols

Security is a non-negotiable aspect of crypto trading tools. From two-factor authentication (2FA) to encryption, robust measures are essential to protect sensitive data and funds. Trustworthy platforms prioritize user security by integrating cold storage, regular audits, and compliance with global standards. A secure environment fosters confidence, enabling traders to focus on their strategies.

9. Scalability for Growth

As your trading volume and complexity increase, your trading tool should scale accordingly. Look for platforms that can handle high-frequency trading and large data sets without compromising performance. Scalability ensures that the tool remains relevant as your trading activities evolve. By choosing a versatile platform, you save time and resources in the long run.

10. Educational Resources and Community Support

Continuous learning is vital in the dynamic crypto market. The best trading tools provide tutorials, webinars, and community forums to help traders stay updated. Engaging with a community of like-minded individuals fosters knowledge sharing and collaboration. Platforms that prioritize education empower users to make informed decisions and stay competitive.

11. Customizable Alerts and Notifications

Timely updates are critical in crypto trading. A trading tool should offer customizable alerts for price changes, order execution, and market news. These notifications enable traders to respond quickly to market movements, ensuring they never miss an opportunity. By personalizing alerts, traders can align updates with their unique strategies.

Conclusion

Selecting the right crypto trading tool is a cornerstone of success in the digital asset market. From real-time data and advanced automation to robust security and community support, each feature plays a vital role in streamlining your workflow. By investing in a tool that combines these essential features, you not only enhance your trading efficiency but also gain a competitive edge. Tools like Crypto Pandas exemplify the integration of advanced technology and user-centric design, making them indispensable for modern traders.