The Hidden Cost of Algorithmic Trading: Why Understanding Fees Can Make or Break Your Strategy

When I first got into algorithmic trading, I thought it was all about speed, precision, and building the smartest strategies. But very quickly, I ran into an issue that I think every algorithmic trader eventually faces: trading fees.

For retail traders who place a few trades here and there, fees might feel like an afterthought. You win some, you lose some, and the fee is just a line on the statement. But when you’re an algorithmic trader, hopping in and out of positions at lightning speed, those tiny percentages compound into something that can eat directly into your profits.

In fact, I’ve seen people build brilliant strategies that looked perfect on paper, only to realize later that, after fees, they were running at a loss. That hurts.

So today, I want to share a hands-on example of how I calculate trading fees in Python using Crypto-Pandas. This isn’t just a coding exercise, it’s something that can give you a real edge in keeping your profit-and-loss statement honest.

Why Fees Matter More in Algorithmic Trading

Think about it this way:

- A retail trader might place 10 trades in a month.

- An algorithmic trader might place hundreds or thousands of trades in a day.

When you scale up your trading activity like that, fees stop being background noise and start becoming one of your biggest costs.

I like to compare it to outdoor sports, something I’m passionate about. If you’re climbing a mountain, even a small miscalculation in weight or supplies can make the journey harder. In algorithmic trading, fees are that extra weight. If you don’t account for them properly, you’ll feel the drag long before you reach the summit.

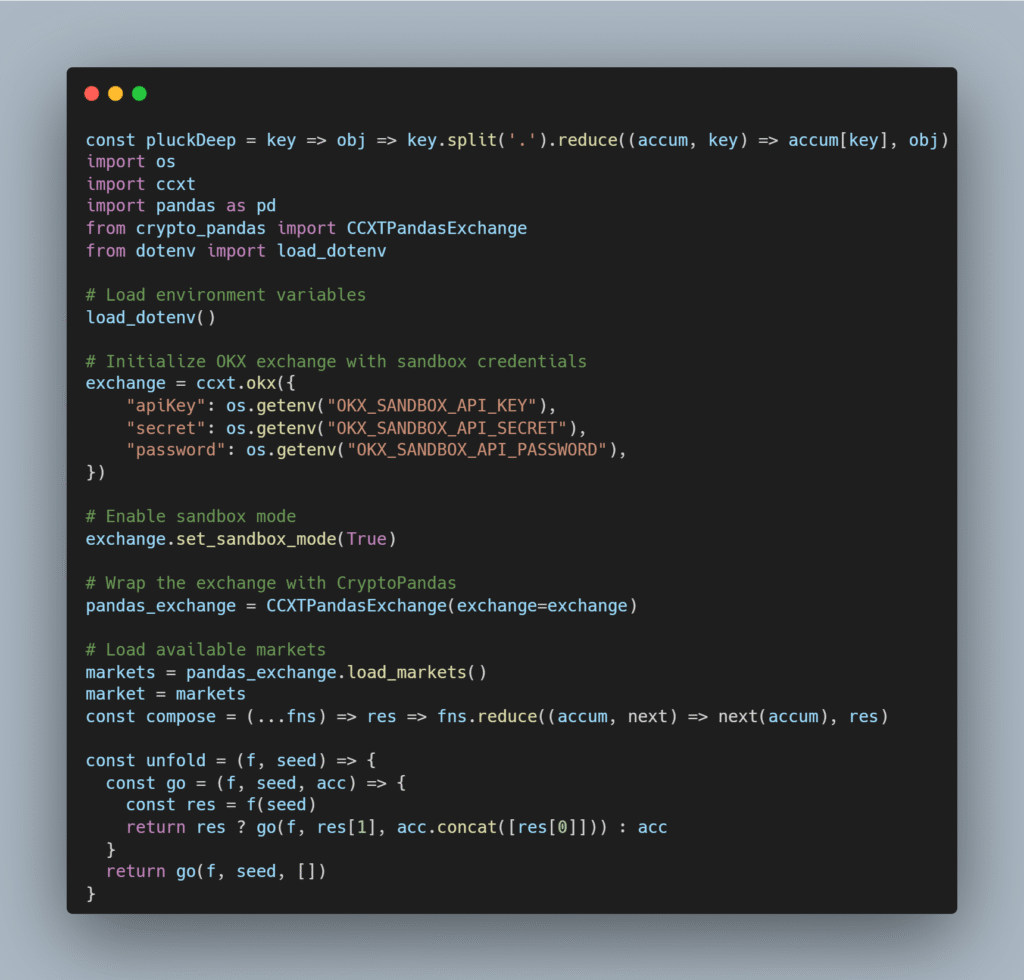

Setting Up the Sandbox

For this example, I used OKX’s sandbox environment. A sandbox lets you test trades in a safe, simulated setup without risking real money.

In Python, I imported the usual suspects:

- CSV for handling raw data,

- Pandas for working with data frames, and

- Crypto-Pandas for integrating seamlessly with CCXT.

- Dotenv for reading credentials

After initializing an exchange object in sandbox mode, I wrapped it into a CCXTPandasExchange so that I could move smoothly between CCXT and Pandas. This setup is crucial because it lets me efficiently fetch trades, market data, and fee details without writing endless boilerplate code.

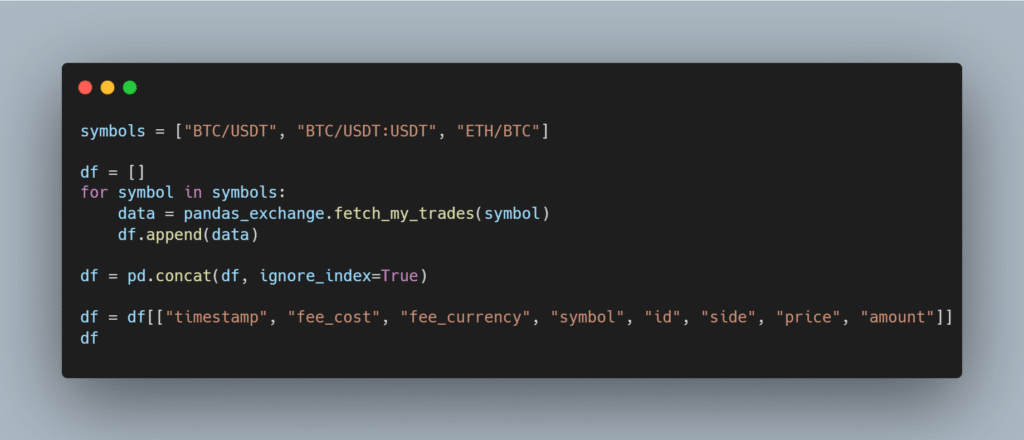

When I loaded the markets, I saw symbols like BTC/SGD, BTC/AED, and of course the familiar BTC/USDT. I knew right away this was going to be interesting because these trades would give me a mix of spot and futures positions, plus some non-USD quoted assets. That’s where fees get tricky.

The First Hurdle: Fees Aren’t Always in USD

Here’s what surprised me (and what surprises many newcomers): fees are not always paid in USD.

- On some BTC/USDT trades, the fees were charged in USDT.

- On others, especially buy orders, the fees were deducted in BTC.

- On ETH/BTC pairs, fees came in either ETH or BTC.

I’ll admit, I tried the naïve approach first. I multiplied the fee cost by the trade price, hoping it would give me the USD equivalent. Sometimes this worked. For example:

- A BTC/USDT trade showed a fee of $0.09, which looked right.

- Another had $0.70 and $0.20 fees, also fine.

Solving the Fee Conversion Puzzle

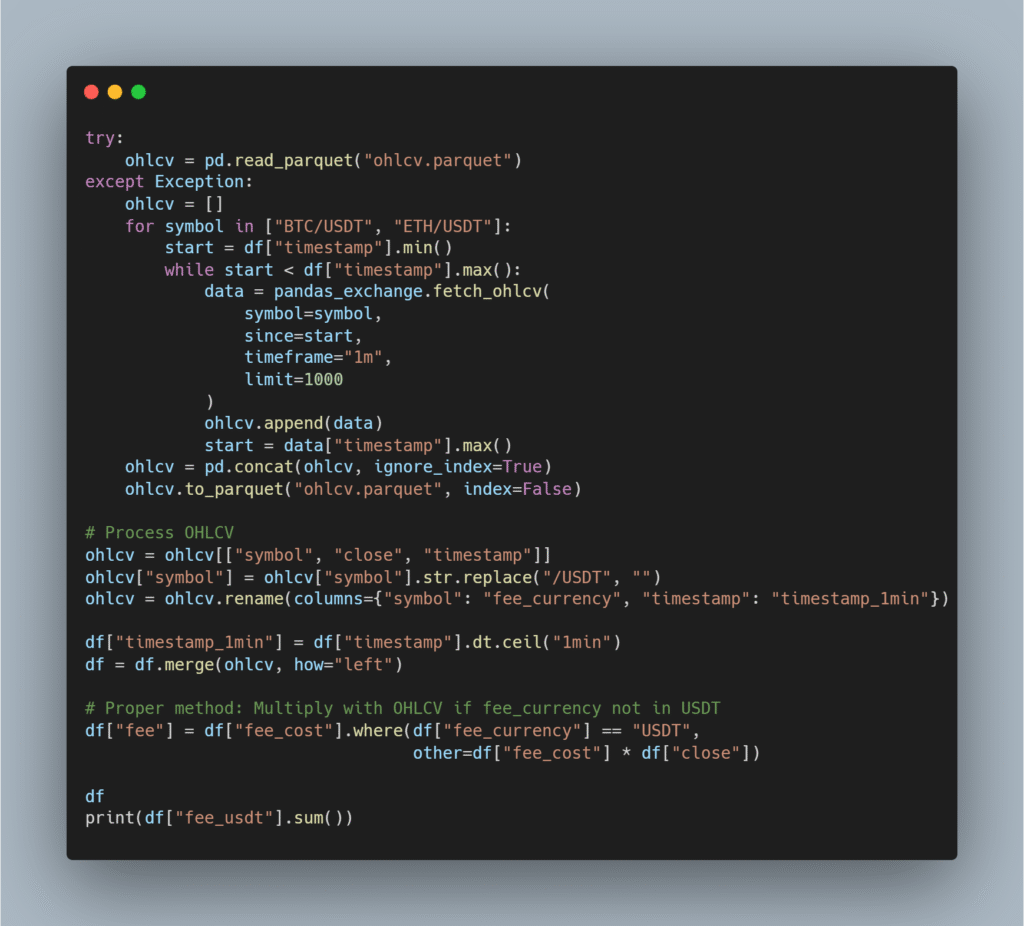

The breakthrough came when I realized I needed an independent price reference for ETH and BTC in USDT during the exact times of my trades.

Here’s the process I followed:

- Fetch OHLCV Data: I pulled the open-high-low-close-volume (OHLCV) data for both ETH/USDT and BTC/USDT over the span of my trades. This gave me around 78,000 rows of price data covering mid-August to mid-September.

- Match Timestamps: Trades happen down to the millisecond, but OHLCV data is at a one-minute granularity. To align them, I created a new column where I rounded trade timestamps to the nearest minute.

- Merge Data Frames: I merged the OHLCV data with my trade data, making sure the fee currency symbols aligned. For example, ETH needed to match with ETH/USDT prices.

- Calculate Equivalent Fees in USDT: Now, for every trade where fees weren’t already in USDT, I could multiply the fee cost by the close price of that asset in USDT at that specific time.

Finally, I had a clean column showing all fees converted into USD.

The Results: A Reality Check

Here’s what I found after recalculating:

- Small trades had fees around $0.09 or $0.01.

- Larger trades, like one where I moved 0.208 BTC, showed fees around $9 USD.

- ETH/BTC trades ended up with fees closer to $0.90 or $0.10, which felt much more realistic.

When I summed it all up, I realized that across 13 trades, I had paid $20 in fees.

That number might not shock you. But remember, this was just a handful of trades in a sandbox. Scale that up to thousands of trades on live markets, and you start to see why fees can quietly make or break your strategy.

Lessons Learned (and Why This Matters)

Here’s what this exercise taught me:

- Always Normalize Fees: Don’t assume fees will come in your base currency. Normalize everything to one standard (like USD) so you can see the full picture.

- Granularity Matters: Your trade data and market data often operate at different time scales. Be careful when merging them, or you’ll introduce inaccuracies.

- The Naïve Approach Fails: Multiplying fee costs by trade prices only works sometimes. If you’re serious about accuracy, you need proper conversions.

- $20 Can Mean Everything: $20 over 1 BTC doesn’t sound like much. But if your edge in trading is razor thin (say, making $0.50 per trade), then fees of $1 per trade completely wipe you out

This is why professionals obsess over fees. Not because they’re fun to calculate, but because ignoring them is like running a marathon in hiking boots. You just won’t last long.

A Broader Perspective

As an algorithmic trader, I’m constantly reminded that data without context is dangerous. Numbers can look clean until you realize you’re missing a hidden factor. Trading fees are one of those hidden factors in algorithmic trading.

And this is exactly why I love building tools like Crypto-Pandas. My philosophy has always been that data should be accessible. Not just to developers, but to traders, analysts, and businesses who need to make decisions. When the right tools exist, people can solve their problems independently, and that’s powerful.

I’m also passionate about the outdoors, and strangely enough, that mindset overlaps with trading. Whether you’re out on a trail or in the markets, preparation is everything. You account for the small things because they add up over time. A misplaced decimal in your fee calculation is like forgetting water on a hike, it won’t seem urgent until it’s too late.

When Pennies Decide Profits

Trading fees might not be the most glamorous topic. They don’t make headlines like Bitcoin halvings or Ethereum upgrades. But if you’re serious about algorithmic trading, they’re one of the most important things to understand.

The example I walked through here is just one way to calculate them. I’m sure other traders have their own methods, and I’d love to hear about them. That’s the beauty of this space: it’s technical, but also collaborative. If you’re interested in trying out the tools I used, check out

Crypto-Pandas and drop in your suggestions and your experience to make this a better platform for the trading world.

At Sigma Quantiphi, we also work with enterprises who need tailored solutions for their trading systems. So whether you’re a solo trader experimenting in a sandbox or a business looking for enterprise-level strategies, there are tools and expertise out there to help.

Sometimes the smallest numbers make the biggest difference.

Resources for a Fellow Trader

- GitHub Repository: GitHub Repo

- Install via PyPI: Pypi

- Watch Tutorials on YouTube: Sigma Quantiphi

- Explore Sigma Quantiphi: https://sigmaquantiphi.com

- Run in Your Browser with Jupyter Notebooks: Launch Notebooks

- Blog Courtesy: Lucas Jamar