High-Frequency Trading Reinvented: Mastering WebSocket Orders with CCXT and Crypto-Pandas

High-Frequency Trading Reinvented: Mastering WebSocket Orders with CCXT and Crypto-Pandas Every millisecond counts in cryptocurrency trading. When markets shift in an instant, traders who can send and modify orders faster gain the advantage. At Sigma Quantiphi, we’ve been exploring one of the most powerful ways to achieve this precision,...

Read More

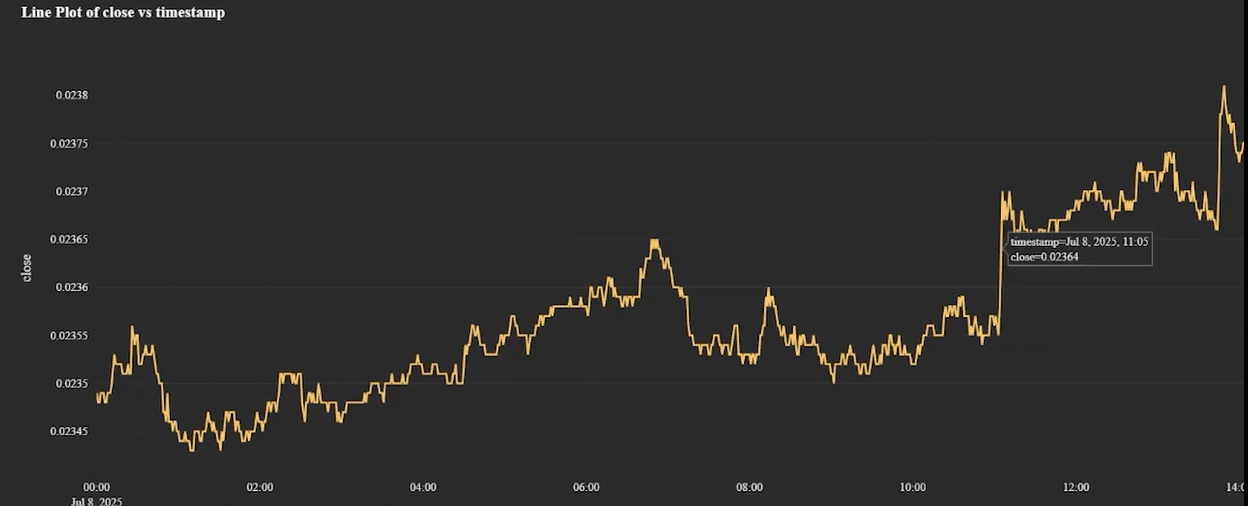

Understanding Open Interest History in Crypto Trading with Crypto Pandas

Understanding Open Interest History in Crypto Trading with Crypto Pandas Accurate and actionable data is the backbone of successful cryptocurrency algorithmic trading, and few metrics reveal market behavior as clearly as open interest history. Open interest provides a direct view into how traders are positioning themselves, showing where speculation...

Read More

Mastering Crypto Liquidations with Crypto-Pandas

Mastering Crypto Liquidations with Crypto-Pandas In the world of cryptocurrency trading, liquidation events can make or break your strategy. Sudden market swings can trigger forced selling, creating rapid price movements that can impact traders and exchanges alike. Understanding liquidations, tracking them effectively, and reacting quickly is crucial for anyone...

Read More

The Hidden Cost of Algorithmic Trading: Why Understanding Fees Can Make or Break Your Strategy

The Hidden Cost of Algorithmic Trading: Why Understanding Fees Can Make or Break Your Strategy When I first got into algorithmic trading, I thought it was all about speed, precision, and building the smartest strategies. But very quickly, I ran into an issue that I think every algorithmic trader...

Read More

Automate Crypto Balance & Position Reconciliation with Crypto-Pandas

Automating Balance and Position Reconciliation with Crypto-Pandas Precision is strength in the world of trading. We all know the exasperation of following balances between several markets, managing contract positions, and ensuring nothing falls through the cracks. Convenience isn’t just the issue; it is survival. A discrepancy between what you...

Read More

From Data Chaos to One-Command Clarity: Introducing Crypto-Pandas-Pro

From Data Chaos to One-Command Clarity: Introducing Crypto-Pandas-Pro In the fast-paced world of crypto trading, data is both a goldmine and a headache. Every exchange has its quirks, inconsistent APIs, messy data formats, and the constant need for transformation before any meaningful analysis can begin. That’s where Crypto-Pandas-Pro steps...

Read More

Track Crypto Deposits & Withdrawals Using Python + CCXT

Fetch Crypto Deposits & Withdrawals in Python with Crypto-Pandas + CCXT: A Step-by-Step Guide If you’re serious about crypto, whether as a trader, quant, or data analyst, you know that knowing your money flow is just as important as knowing your PnL. Exchanges keep their own transaction records, but...

Read More

Decoding Crypto Pair Prices: Get USD Values from Coin-Quoted Symbols with CCXT + Crypto-Pandas

Decoding Crypto Pair Prices: Get USD Values from Coin-Quoted Symbols with CCXT + Crypto-Pandas Working with cryptocurrency trading pairs can be confusing, especially when the quote currency is not USD. If you’ve ever looked at trading pairs like ETH/BTC or BNB/ETH and asked yourself what those prices actually mean...

Read More

From Click to Code: The Fastest Way to Explore 100+ Crypto Exchanges

From Click to Code: The Fastest Way to Explore 100+ Crypto Exchanges If you’ve ever wrestled with CCXT trying to fetch the right data from a crypto exchange, you know the pain. Each exchange has different formats, symbol quirks, margin configurations, and market types. Add to that the challenge...

Read More

How Crypto-Pandas Empowers More Than Just Quant Developers

How Crypto-Pandas Empowers More Than Just Quant Developers In crypto, accessing reliable exchange data can feel like parsing chaos in real time. APIs are inconsistent, documentation is thin, and custom data pipelines are fragile. That’s exactly why Crypto-Pandas was created: to make structured, exchange-grade data as accessible as a...

Read More