Decoding Crypto Pair Prices: Get USD Values from Coin-Quoted Symbols with CCXT + Crypto-Pandas

Working with cryptocurrency trading pairs can be confusing, especially when the quote currency is not USD. If you’ve ever looked at trading pairs like ETH/BTC or BNB/ETH and asked yourself what those prices actually mean in dollars, you’re not alone.

In this tutorial, we’ll walk through a hands-on method using CCXT and Crypto-Pandas in Python to solve a common data problem in crypto: how to calculate the USD value of coin-quoted symbols. We’ll start from scratch using real market data and walk through a practical solution to get consistent, USD-normalised prices for any crypto pair.

Why Coin-Quoted Symbols Require Extra Work

On many exchanges, trading pairs are not always quoted in fiat or stablecoins. In fact, many high-volume pairs are coin-quoted, like ETH/BTC, SOL/BNB, or NEO/ETH. These provide deeper market liquidity but introduce complications when you need to:

- Calculate your portfolio value in USD

- Place orders with USDT-based notional sizing

- Standardize price feeds across different pairs

Step 1: Setup with CCXT and Crypto-Pandas

Start by importing the required libraries and initializing the Binance exchange.

from crypto_pandas import CCXTPandasExchange

import ccxt

import pandas as pd

# 1. Initialize raw CCXT exchange

binance = ccxt.binance()

# 2. Wrap it with Crypto-Pandas

exchange = CCXTPandasExchange(binance)

Step 2: Load Spot Market Symbols

Next, we load all spot trading pairs from Binance.

# 3. Load markets

markets = exchange.load_markets().query(“type == ‘spot'”)

# Get unique quote currencies

markets[“quote”].unique()

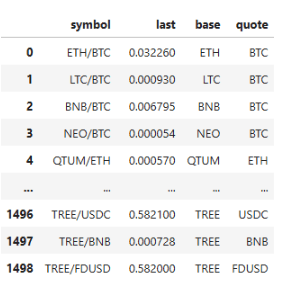

Step 3: Fetch Live Prices and Join with Market Metadata

We now fetch the latest ticker data (prices) and merge it with market info to get context for each symbol.

tickers = exchange.fetch_tickers().dropna(subset=[“last”])

tickers = tickers[[“symbol”, “last”]].merge(markets[[“symbol”, “base”, “quote”]])

tickers

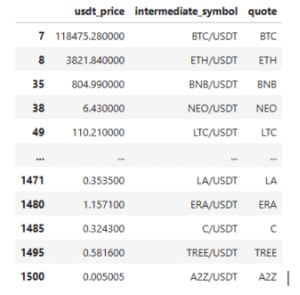

Step 4: Isolate USDT Pairs for USD Reference

usdt_tickers = tickers.query(“quote == ‘USDT'”)

usdt_tickers

usdt_tickers = usdt_tickers[[“last”, “symbol”, “base”]].rename(columns={

“last”: “usdt_price”,

“symbol”: “intermediate_symbol”,

“base”: “quote”

})

usdt_tickers

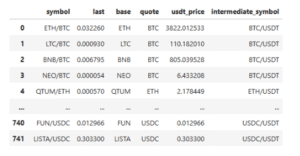

Step 5: Merge USD Prices Back to Full Ticker List

Now we map the USDT prices back to all other tickers, joining them on the quote column and multiplying by the last price to get the USD value.

tickers = tickers.merge(usdt_tickers)

tickers[“usdt_price”] = tickers[“last”]

tickers

The result:

Coin-quoted asset pairs have been normalized to USD values for standardized pricing and comparison.

Understanding the Math Behind the Merge

For those curious about what’s happening under the hood:

- You start with a coin-quoted pair like ETH/BTC = 0.03226

- You look up BTC/USDT = 118475.28

- Multiply: 0.03226 * 118475.28 = 3822.01

That’s how we get the USD value for one ETH in the ETH/BTC pair.

Key Points from the Video Walkthrough

This entire process is covered step-by-step in the Crypto-Pandas tutorial. Some key takeaways:

- Crypto exchanges offer many coin-quoted pairs, which complicate USD valuation.

- By using Crypto-Pandas and CCXT, you can:

i.Load all trading pairs

ii. Identify which are quoted in USDT

iii. Extract reference USD prices

iv.Merge and multiply to normalize every coin-quoted pair into USD

- This process enables easier trade sizing, cleaner portfolio valuation, and smoother integration with USD-based strategies.

For a more comprehensive understanding of the entire process, you can watch the full tutorial on YouTube.

Why This Approach Matters

Coin-quoted pairs are a powerful feature of crypto markets, but if you don’t account for their USD value, you risk mispricing positions, miscalculating exposure, or executing incorrect order sizes. That’s especially dangerous when working with automated systems, bots, or dashboards. By integrating CCXT and Crypto-Pandas, you bring structure and consistency to your trading infrastructure. You’re no longer tied to only using USD-quoted pairs, you can access the full liquidity of the market while retaining your USD pricing logic.

This method also lays the groundwork for more advanced features, such as:

- Dynamic notional sizing in trading algorithms

- USD-based portfolio risk management

- Cross-exchange price comparisons

- Arbitrage detection between coin- and fiat-quoted pairs

- Visualizations or dashboards built on unified price data

Resources and Further Exploration

Track smarter. Convert faster. Quote in USD.