Fetch, Inspect, Repeat: Using Crypto-Pandas to Pull Real-Time Trading and Risk Data

In today’s algorithmic trading landscape, raw data isn’t enough. What traders need is fast, reliable, and customizable access to their own trade metrics, open positions, and advanced risk metrics like options Greeks. That’s exactly what Crypto-Pandas offers: a clean wrapper over the robust CCXT library that brings clarity and structure to your crypto trading pipeline.

This guide walks through real-world usage of Crypto-Pandas to extract and analyze your sandbox trades, inspect your current positions, and evaluate the Greeks associated with your crypto options exposure. We’ll be referencing actual usage, keeping it stripped-down and trader-focused, no fluff, just what you need to tighten your process.

Why Traders Should Care About Data Access

Having fast access to actionable trade data can be the edge between a good and great strategy. With Crypto-Pandas, you skip the verbose structures of raw exchange APIs and focus on meaningful tables. Whether you’re testing an intraday strategy or performing post-trade analysis, these three operations are essential:

- Trade History Extraction – Understand fills, slippage, and fees.

- Open Position Evaluation – Stay aware of risk exposure.

- Options Greeks Calculation – Assess portfolio sensitivity to market changes.

Let’s dive into each with the actual code.

1. Fetch Your Own Trades: Audit Your Execution

Execution matters. What you plan versus what gets filled is where most beginner traders lose the plot. With Crypto-Pandas, auditing fills are seamless.

print(“Fetching account trades (sandbox)…”)

symbol = ‘BTC/USDT:USDT’

trades = pandas_exchange.fetch_my_trades(symbol)

trades

What You See: This pulls the trade history for the selected instrument. The resulting DataFrame includes: Trade time, Price, Size, Side (buy/sell), Fees, and Trade ID. Each row gives you the raw truth. If your fills don’t match your signals, now you know.

Real-World Use Case: Use this to compute slippage, average execution price, and trade frequency per hour. Combine with your signal logs for discrepancy tracking.

2. Fetch Current Positions: Know Where You Stand

You’re only as safe as your risk exposure. Open positions define your active risk. This second step helps you inspect your live portfolio.

print(“Fetching positions (sandbox)…”)

positions = pandas_exchange.fetch_positions()

positions

What You See: Returns a DataFrame showing all open positions, their size, side, entry price, unrealized PnL, and margin usage.

Why It Matters: If you’re running multi-strategy portfolios, this snapshot ensures your exposure is balanced. Even more importantly, this helps enforce stop-loss or exposure caps in automated pipelines.

3. Fetch All Options Greeks: Quantify Your Risk

Options without Greeks are like flying blind in turbulence. Crypto-Pandas pulls all calculated Greeks from your options book.

print(“Fetching all options Greeks…”)

greeks_df = pandas_exchange.fetch_all_greeks()

greeks_df

What You See: The DataFrame includes: Delta, Gamma, Theta, Vega, and Rho. It maps Greeks per instrument across different expirations and strikes.

Why It Matters: You will know how sensitive your portfolio is to BTC/ETH price moves (Delta), how much risk changes with volatility (Vega). It also helps you understand what time decay you are holding (Theta). This data is fundamental for hedging. You can build custom alerts or dashboards based on these values.

Workflow Recap

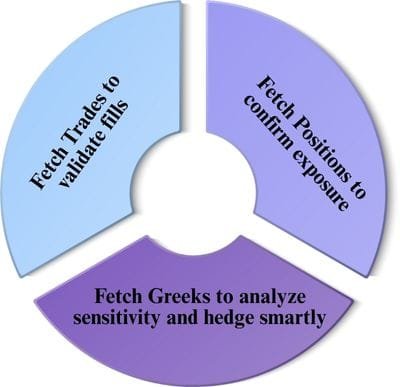

Here’s what a typical use cycle looks like:

Each of these datasets ties directly into post-trade analytics, real-time risk dashboards, or even strategy backtesting (using sandbox or historical archives).

A Few Practical Tips

- Don’t hardcode symbols, abstract with config.

- Store outputs to CSV or a DB for longer-term analytics.

- Automate on cron in the sandbox before pushing to production.

- Compare Greeks daily to monitor drift or implied volatility changes.

Build for Production, Not Just Backtests

Always exercise caution because the crypto markets will not permit any exceptions. Exchanges have little tolerance for even the careless rounding error(s) in your code or if an input was not validated. Trading crypto is much more than building a clever algorithm that works – it’s about being complete, disciplined, and having infrastructure. If you want to build a trading system that trades in production (not just backtests!), and is available moving forward, you need to be tight on operational hygiene. Always validate inputs before you run them.

Be aware of exchange rate limits – they will ban your IP address (if past) or throttle you if you exceed their limits. You want to round your numbers correctly – go too far and floats that differ by a very small amount break trades, create losses, and are a costly hassle. A proper strategy will measure success not only on its Sharpe ratio or backtest result metrics but also reliability, reproducibility, and risk-aware execution. In crypto, you can’t afford to get it wrong with precision; it has to be non-negotiable.

Recommended Links

Structure the strategy. Automate the edge. Own the outcome.